The energy transition will only be truly successful if lower emissions are achieved with tangible economic benefits. Iñigo Jodra, Enzen’s Head of Business Consulting for Iberia, Latin America and Africa, discusses why Totex (Capex + Opex) optimisation is one of the most important management challenges and opportunities for power and gas utilities.

Enhancing the functionality and efficiency of energy networks will be instrumental to our planet’s net zero aspirations. Power and gas utilities will play a major role in the evolution towards non-fossil fuels (eg. renewable gases transportation, renewable generation integration) and will drive empowerment of all stakeholders to embrace new energy value chains (eg. grid flexibility services).

In every geography, decarbonising these networks and greening wider economies means combining the creation of new capacity with the physical or digital improvement of existing infrastructure, whether it be substations, power lines, poles or pipes. This requires huge investment. For example, Euroelectric estimates that an average of €67 billion per year should be invested in Europe’s distribution grids between 2025-50.

Inventive approaches to investment management

Such a massive undertaking will only be truly effective and sustainable if it achieves the twin objectives of lowering emissions and driving profitable growth in the energy sector.

Much will depend on regional and national regulations evolving in the right direction, of course. No matter what the specifics of a nation’s energy infrastructure, astute policymaking supported by robust planning and governance will always be a critical factor in unlocking long-term benefits in utilities.

Nevertheless, equally important will be more inventive approaches to optimising capital and operational spend. This is where power and gas utilities can benefit financially, while addressing the increased demand for low-carbon energy and delivering an impactful contribution to sustainability.

How can utilities be smarter in combining return on investment and value maximisation?

Historically, the industry has long seen Capital Expenditure (Capex) and Operational Expenditure (Opex) as standalone economic indicators, with Total Expenditure (Totex) resulting from the sum of the parts.

Traditionally, Capex spend has been added to the Regulatory Asset Value (RAV) which is used to value utility companies. Hence companies and shareholders have preferred using Capex to modernise the network as opposed to refurbishment, because the latter isn’t added to the RAV.

However, a focus on Capex only offers a suboptimal outcome from a financial value perspective, particularly when considering the long-term view.

In light of this, the traditional approach is evolving towards Totex-based decision-making, encouraging shareholders to consider a more holistic Replace, Refurbish and Maintain option. For instance, UK regulation combines ‘slow-money’ (where expenditure is capitalised and recovered over 20-30 years) and ‘fast-money’ (expenditure is recovered within a one-year period) mechanisms.

Under the new Totex regime, parts of the maintenance and refurbishment expenditure and the entire replacement expenditure are considered slow-money and get added to the RAV. This incentivises utilities and shareholders to optimise the asset interventions mix under a logical financial and risk framework.

Combining economic and sustainability impact

Based on our utilities experience, we believe a holistic Totex approach with optimal interventions along the lifecycle of the asset can improve the asset’s economic performance by a range of 15-25% when compared with the traditional Capex + Opex sequential improvement practice.

In addition to its economic impact, the Totex model accelerates the energy transition. A classic example is the growth of renewable energy integration into the grid. Until March 2023, the cost of a renewable connection to the grid and the cost of upstream reinforcement needed were paid by the developer and capitalised by the network operator respectively.

From April 2023, the new regulations require the network operator to capitalise both components, from which they get a slow-money allowance. This regulatory development has completely changed the way the networks handle the applications of connections to the grid.

A whole asset lifecycle optimisation mindset

Forward-thinking utilities have overcome this mechanical and static view of Totex and are embracing a proactive and dynamic approach, targeting asset value optimisation.

Focusing on Totex returns emphasises the infrastructure’s economic and operational performance along the whole lifecycle over time, rather than just the initial outlay and planning. The shift places the focus on achieving outcomes: a change in paradigm that aligns to the wider goal of accelerating the drive to profitable sustainability, leveraging low-carbon solutions and developing a circular approach to asset management.

In a management system driven by Totex optimisation, the different asset intervention options (replace, refurbish or maintain) are periodically evaluated using economic and risk monetisation models.

A transformation journey

How can utilities incorporate Totex optimisation practices? Fundamentally it requires a journey of transformation: one that demands taking the traditional operating models to the next level and harnessing the power of data and digitalisation towards smart automation.

Enzen is an established transformation partner for many major utilities, including UK Power Networks and Wales & West Utilities in the UK and Essential Energy in Australia. From our experience we’ve seen how successfully combining vision, strategic direction, method and determination can achieve quantum leaps in efficiency and value.

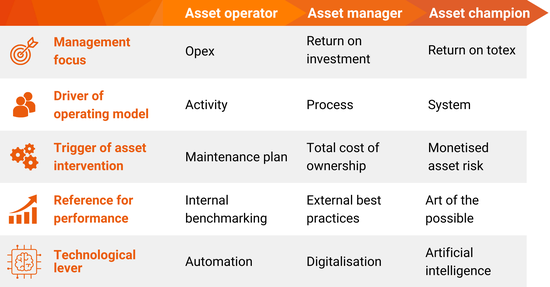

Totex optimisation transformation has different stages that must be addressed sequentially. All are necessary if a utility is going to progress from an ‘Asset Operator’ into an ‘Asset Champion’ ie. an organisation maximising value from infrastructure and with the visibility and tools available to drive continual improvement in this area.

Forward-thinking energy utilities are applying these principles, and optimising their asset interventions, by combining dynamic data-driven modelling with robust and flexible IT infrastructure. This is facilitated by transversal organisational frameworks and cutting-edge technologies like digital asset management and Artificial Intelligence.

Crucially, these utilities have played the long game too, achieving excellence through complex, multi-year cross-company programmes tirelessly led by senior leadership and endorsed by shareholders. They truly believe in it.

The increasing value of strategic differentiation

The energy transition is challenging existing modes of thinking and disrupting long-established practice. In a changing landscape of new regulations and ambitious investment scenarios, power and gas utilities have more opportunity than ever to identify new strategic and operational levers that will enhance their financial value and ESG performance.

This capacity to differentiate in terms of strategy and innovation is opening the gulf between the high-performing and low-performing utilities. By way of example, the highest and lowest RoRE (Return on Regulatory Equity) of UK power distribution network operators were 11.2% and 8.3% respectively in 2022.

The unstoppable governmental and social push towards sustainability will naturally increase the interest of the financial community on energy network utilities.

A good precedent of this is the waste management sector, in which infrastructure investment funds and private equity firms have invested more than €10 billion in major European environmental services players in the last three years. The role of this sector as a key enabler of the circular economy and the growth of renewable fuels and materials, together with the favourable regulatory developments, have unlocked the financial value of the best-positioned players.

The growing complexity of the energy landscape will breed opportunity. As with any major change, there will be winners and losers, depending on who can seize the moment and execute effectively for the long-term.